In-School Loan Program

6.65% Fixed Annual Rate

(not FICO score driven)

%

Any questions? Please call 860-520-4001

- The student is always the borrower on a CHESLA loan.

- Must be at least the age of majority or older at the time of application based on his/her state of permanent residence. If you are a Connecticut resident under the age of 18, you can still apply with a required co-borrower.

- CHESLA loans allow 1 co-borrower on the loan.

- Borrower must be a Connecticut resident attending a non-profit, degree granting institution of higher education in the United States; or a resident of Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island or Vermont attending an eligible Connecticut state or non-profit, degree granting institution of higher education.

- Co-Borrower must be a resident of Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, or Vermont.

- CHESLA encourages you to exhaust your financial aid, scholarship, and Direct Subsidized/Direct Unsubsidized federal student loan options before applying for a CHESLA loan.

- CHESLA loans are available for undergraduate and graduate students.

Loan Rate for the 2025-2026 Academic Year

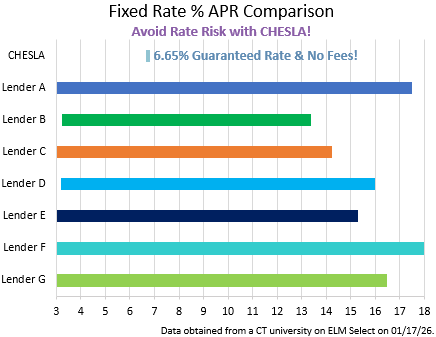

- 6.65% Fixed Annual Rate (guaranteed rate, not FICO score driven).

- 0.25% ACH interest rate reduction is available.

- Annual Percentage Rate (which accounts for any fees) is 6.65%.

- Low monthly payments of $5.54 per $1,000 borrowed during the in-school and 6-month grace period, and $10.29 per $1,000 borrowed during the 140-month repayment term for principal and interest.

Qualifying Criteria

There are 3 criteria to qualify for a loan:

- Minimum gross annual income of $20,000

- A Debt-to-Income ratio (DTI) that does not exceed 43%

- Credit worthy, as determined by a commercial credit report

If a student does not meet all 3 criteria, then the co-borrower needs to meet all 3 criteria for loan approval.

Our Impact

In-School Loans

In-School Loan Volume

Refinance Loans

Refinance Loan Volume

Scholarships

Scholarship Volume

Loan Features & Terms

- Loans are disbursed directly to the institution.

- No application fee or origination fee. No fees, period!

- No application deadline

- Loans from $2,000 up to the total cost of education per academic year (less any other financial aid received), to a cumulative maximum total of $125,000

- Loans for either current or immediate prior year’s educational expenses

- Principal and interest payments over an extended 140-month repayment term after the grace period ends

- No prepayment fee

- Borrower death forgiveness

- Borrower total and permanent disability forgiveness

- Co-borrower release feature for loans disbursed on or after June 23, 2014

Undergraduate Students: Interest-only payments are required while student is in school and for a 6-month grace period after student leaves school. Loans originated through June 2016 can stay in interest-only up to a five-year maximum. Loans originated after June 2016 can stay in interest-only up to an eight-year maximum.

Graduate and Professional Students: May defer interest while in school and for a 6-month grace period (interest is capitalized annually)

Eligible Borrowers & Co-Borrowers

- Must be at least the age of majority or older at the time of application based on his/her state of permanent residence. If you are a Connecticut resident under the age of 18, you can still apply with a required co-borrower.

- Must be a U.S. Citizen or an Eligible Non-Citizen.

- You must reside in the U.S. at the time of the application.

- Effective March 1, 2025: Borrower must be a Connecticut resident attending a non-profit, degree granting institution of higher education in the United States; or a resident of Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island or Vermont attending an eligible Connecticut state or non-profit, degree granting institution of higher education.

- Effective March 1, 2025: Co-Borrower must be a resident of Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, or Vermont.

- A student must be making satisfactory academic progress.

- A student or co-applicant(s) (if any) must be credit worthy, as determined by a commercial credit report.

- A student or co-applicant(s) (if any) must have monthly debt payments amounting to 43% or less of monthly gross income (Debt-to-Income ratio).

- A student or co-applicant(s) (if any) must have a minimum $20,000 annual gross income. There is no maximum income limit.

NOTE: Applicants are encouraged to pay off any AMEX debt before applying. American Express typically reports the entire balance as the monthly payment, which can drastically impact your Debt-to-Income ratio.

Clicking ‘Apply Now’ will leave the CHESLA website and take you to Campus Door’s website to complete the loan application.

CT Financial Aid Code of Conduct

The Connecticut Higher Education Supplemental Loan Authority (CHESLA) supports and subscribes to the Connecticut Financial Aid Code of Conduct (click here to view/download the code). Please note the following disclosure(s):

- CHESLA has no plans to sell your CHESLA loan to another lender, and CHESLA has never sold a CHESLA loan. However, CHESLA does have the power to do so.

- The Terms and Benefits of your CHESLA Loan will NOT change if the loan is sold to another lender.