Undergraduate Student Loans

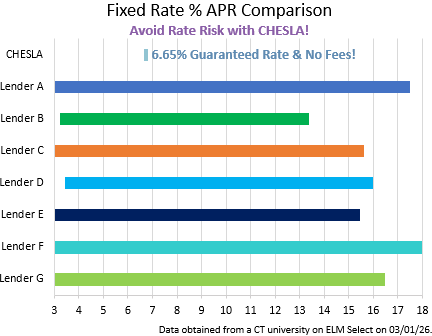

6.65% Fixed Annual Rate

(not FICO score driven)

%

Alguma pergunta? Por favor ligue 860-520-4001

- O aluno é sempre o mutuário do empréstimo CHESLA.

- Must be at least the age of majority or older at the time of application based on his/her state of permanent residence. If you are a Connecticut resident under the age of 18, you can still apply with a required co-borrower.

- Os empréstimos CHESLA permitem 1 co-mutuário no empréstimo.

- Borrower must be a Connecticut resident attending a non-profit, degree granting institution of higher education in the United States; or a resident of Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island or Vermont attending an eligible Connecticut state or non-profit, degree granting institution of higher education.

- Co-Borrower must be a resident of Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, or Vermont.

- CHESLA incentiva você a esgotar suas opções de ajuda financeira, bolsa de estudos e empréstimos federais subsidiados / diretos não subsidiados para estudantes antes de solicitar um empréstimo CHESLA.

- Os empréstimos CHESLA estão disponíveis para estudantes de graduação e pós-graduação.

Loan Rate for the 2025-2026 Academic Year

- 6.65% Fixed Annual Rate (guaranteed rate, not FICO score driven).

- A redução da taxa de juros ACH de 0,25% está disponível.

- A taxa percentual anual (que contabiliza quaisquer taxas) é 6.65%.

- Baixo pagamentos mensais de $5.54 por $1,000 emprestado durante o período de carência escolar e de 6 meses, e $10.29 por $1,000 emprestado durante o prazo de reembolso de 140 meses para principal e juros.

Qualifying Criteria

There are 3 criteria to qualify for a loan:

- Minimum gross annual income of $20,000

- A Debt-to-Income ratio (DTI) that does not exceed 43%

- Credit worthy, as determined by a commercial credit report

If a student does not meet all 3 criteria, then the co-borrower needs to meet all 3 criteria for loan approval.